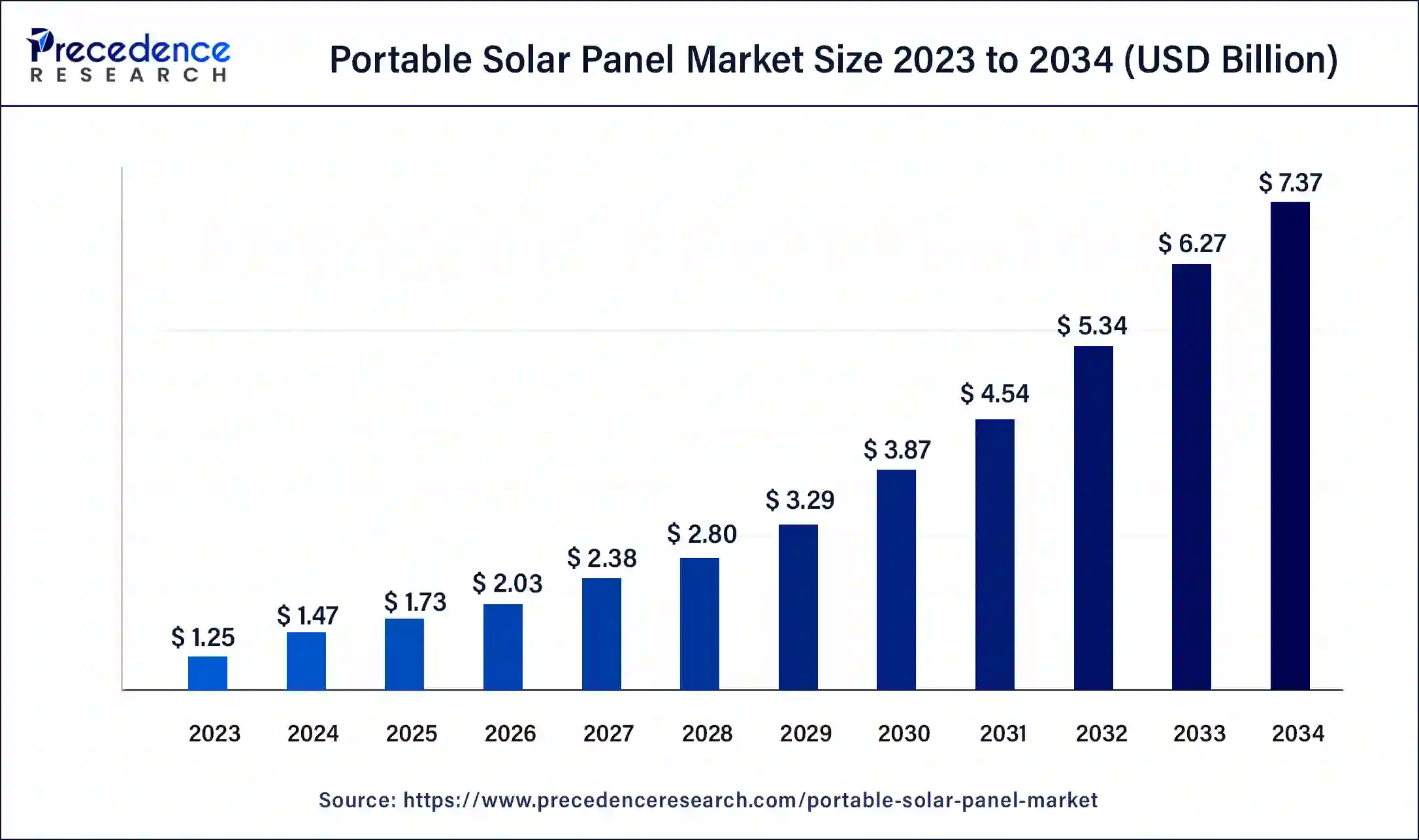

The global portable solar panel market size is estimated at USD 1.47 billion in 2024 and is predicted to surpass around USD 7.37 billion by 2034 with a remarkable CAGR of 17.5% from 2024 to 2034.

The portable solar panel market has seen significant growth, driven by increasing demand for clean, renewable energy solutions and the rising popularity of outdoor activities, such as camping and hiking. Portable solar panels offer a convenient way to power small electronics and off-grid devices, appealing to both adventure enthusiasts and those in regions with limited access to electricity. Technological advancements have led to lighter, more efficient, and durable designs, making them increasingly accessible. Growing environmental awareness and government initiatives promoting solar energy adoption further boost the market’s expansion, particularly in North America and Europe.

Table of Contents

TogglePortable Solar Panel Market Trends

- Rising Popularity in Outdoor Activities: The surge in outdoor recreational activities, such as camping, hiking, and RV trips, has significantly driven the demand for portable solar panels. A study found that 57.8 million households in the U.S. went camping in 2022, reflecting a growing market for portable energy solutions.

- Increase in Battery Integration: More portable solar panel systems are being integrated with advanced battery storage options. In 2023, nearly 45% of portable solar systems came with integrated battery storage, allowing for better energy management and extended usage.

- Technological Advancements in Solar Efficiency: Improvements in solar panel efficiency have become a key trend. In 2024, portable solar panels achieved an average efficiency rate of 23%, compared to 20% in 2020, enhancing power generation even in compact models.

- Compact and Lightweight Designs: Manufacturers are focusing on developing more lightweight and compact panels without compromising power output. Panels weighing less than 10 lbs accounted for 32% of the market in 2023, making them more suitable for backpackers and travelers.

- Shift Towards Eco-friendly Materials: The use of eco-friendly and recyclable materials in portable solar panels is gaining traction. As of 2023, about 18% of new portable solar panels are made with materials that have a lower environmental impact.

- Growing Adoption in Emergency Preparedness: The need for off-grid solutions in emergencies has boosted the market for portable solar panels. It was reported that around 25% of buyers in 2023 cited emergency preparedness as the primary reason for purchasing portable solar panels.

- Wireless Charging Capabilities: Increasing demand for wireless charging has led to innovations in solar panel designs. In 2023, around 15% of portable solar panels featured wireless charging capabilities for smartphones and small electronics.

- Rising Demand in Developing Regions: There has been growing demand for portable solar panels in regions with limited access to electricity. In 2023, over 38% of sales were attributed to developing countries, driven by government initiatives to promote renewable energy adoption.

- Customization and Modular Systems: Customizable and modular portable solar systems are becoming popular. In 2023, 28% of consumers opted for panels that allowed expansion by adding more panels to the system as needed.

Case Study: Growth of Portable Solar Panels in Rural India (2022-2024)

Sales Increase: SolarLite saw a 45% increase in sales from 2022 to 2024.

Impact on Rural Electrification: Over 100,000 rural homes adopted portable solar panels, benefiting from consistent energy for lighting and small appliances.

Sustainability Impact: It contributed to a reduction of around 10,000 tons of CO2 emissions annually by reducing dependency on diesel generators.

North America held the largest share of the portable solar panel market in 2023

North America has become a dominant player in the portable solar panel market due to several factors, ranging from increasing demand for renewable energy to strong government support. The region has witnessed significant growth in the adoption of portable solar panels for personal, residential, commercial, and military applications. Here’s a breakdown of the key factors contributing to North America’s dominance:

Increasing Demand for Renewable Energy

- Energy Awareness: A significant increase in environmental awareness has driven the demand for renewable energy sources, especially solar power. The U.S. Energy Information Administration (EIA) reports that renewable energy contributed about 21% of total U.S. electricity generation in 2021, with solar energy accounting for 14% of the renewable share.

- Consumer Preferences: Consumers in the region are increasingly inclined towards off-grid and portable energy solutions. Portable solar panels are now popular for outdoor recreational activities like camping, hiking, and emergency backup systems.

Technological Advancements

- High-Efficiency Solar Panels: U.S.-based companies such as SunPower and First Solar have been at the forefront of developing high-efficiency, lightweight, and portable solar panels. These products are becoming more cost-effective and easier to deploy.

- Battery Integration: The integration of solar panels with battery storage systems has further accelerated adoption, especially in regions prone to power outages and natural disasters. North America is a leader in advanced battery technology, driving the efficiency of portable solar systems.

Government Support and Incentives

- Tax Credits and Rebates: The U.S. government has implemented several programs to support solar energy adoption. The federal Investment Tax Credit (ITC) allows individuals and businesses to deduct 30% of the cost of installing solar systems from federal taxes. This incentive applies to residential and commercial solar panel installations, which can include portable solar solutions.

- State-Level Programs: In addition to federal support, states like California, New York, and Texas offer rebates, subsidies, and net metering programs to encourage solar panel adoption. California’s “Million Solar Roofs” initiative aims to have over 3,000 megawatts (MW) of solar power installed by 2025, benefiting both stationary and portable solar markets.

- Green Energy Policies: The U.S. government aims to achieve net-zero carbon emissions by 2050, and portable solar solutions are an essential part of achieving this goal, as they promote energy independence and sustainable power generation.

Increased Use in Outdoor and Emergency Applications

- Outdoor Recreation Market: The North American market for outdoor activities is vast, and portable solar panels are gaining traction among outdoor enthusiasts. In 2021, the outdoor recreation market in the U.S. was valued at $689 billion, with portable solar panels being widely adopted for activities like hiking, camping, and RV travel.

- Disaster Preparedness: As North America is frequently affected by natural disasters like hurricanes, wildfires, and blizzards, portable solar panels offer a reliable power source during emergencies. Government and military sectors have increased the use of solar power for disaster relief operations.

Military Applications

- U.S. Military Investment: The U.S. military has been heavily investing in portable solar panels for tactical and field use. The Department of Defense is one of the largest consumers of renewable energy in the U.S., and portable solar panels are a part of energy security strategies in remote operations. These systems provide soldiers with mobile, sustainable power in the field, reducing the need for traditional fossil fuel-based generators.

Favorable Climate Conditions

- Sunlight Availability: Large parts of North America, particularly in the southwestern U.S., experience abundant sunlight throughout the year. States like Arizona, Nevada, and California receive over 250 sunny days annually, providing ideal conditions for solar energy generation, including portable solar applications.

Corporate Investments and Market Innovation

- R&D and Manufacturing Investments: North American companies are leading the charge in research, development, and innovation in solar technology. Significant investment in R&D has resulted in lighter, more efficient, and more durable portable solar panels.

- Corporate ESG Commitments: Several corporations have committed to renewable energy as part of their Environmental, Social, and Governance (ESG) goals. These initiatives drive demand for solar technologies across the board, including portable solar solutions for corporate use and supply chain applications.

Tabular Breakdown of Key Factors in North America’s Dominance in Portable Solar Panel Market

| Factor | Details | Data/Stats |

|---|---|---|

| Consumer Awareness | Increased environmental awareness and shift towards renewable energy | 21% of total U.S. electricity generation was from renewable sources in 2021 (EIA) |

| Technological Advancements | High-efficiency and lightweight solar panels developed in the U.S. | Companies like SunPower and First Solar lead in innovation, providing panels with up to 22.6% efficiency |

| Government Support | Federal and state-level incentives for solar energy adoption | Federal ITC offering a 30% tax credit for solar systems, including portable solar installations |

| Outdoor Recreation and Emergency Applications | Growing use of portable solar panels for recreational and emergency purposes | U.S. outdoor recreation market valued at $689 billion in 2021, with high demand for portable energy sources |

| Military Applications | U.S. military investment in portable solar for tactical operations | The U.S. military is a major consumer of portable solar energy, reducing reliance on fossil fuels during field operations |

| Climate and Sunlight Availability | Favorable climate conditions in key states for solar energy | Arizona, Nevada, and California receive over 250 sunny days per year, ideal for solar generation |

| Corporate Investment | Strong corporate commitment to renewable energy in North America | Large investments in R&D and market innovation have resulted in more efficient and accessible portable solar panels, with companies setting ambitious ESG and sustainability goals |

Portable Solar Panel Market Companies

- Tata Power

- PowerFilm Solar, Inc.

- EcoFlow

- Innotech Enterprise LLC

- ACOPOWER Bluetti Power

- Jinko Solar

- Jackery Inc.

- Shenzhen Ouliyang Technology Co., Ltd

- REDARC