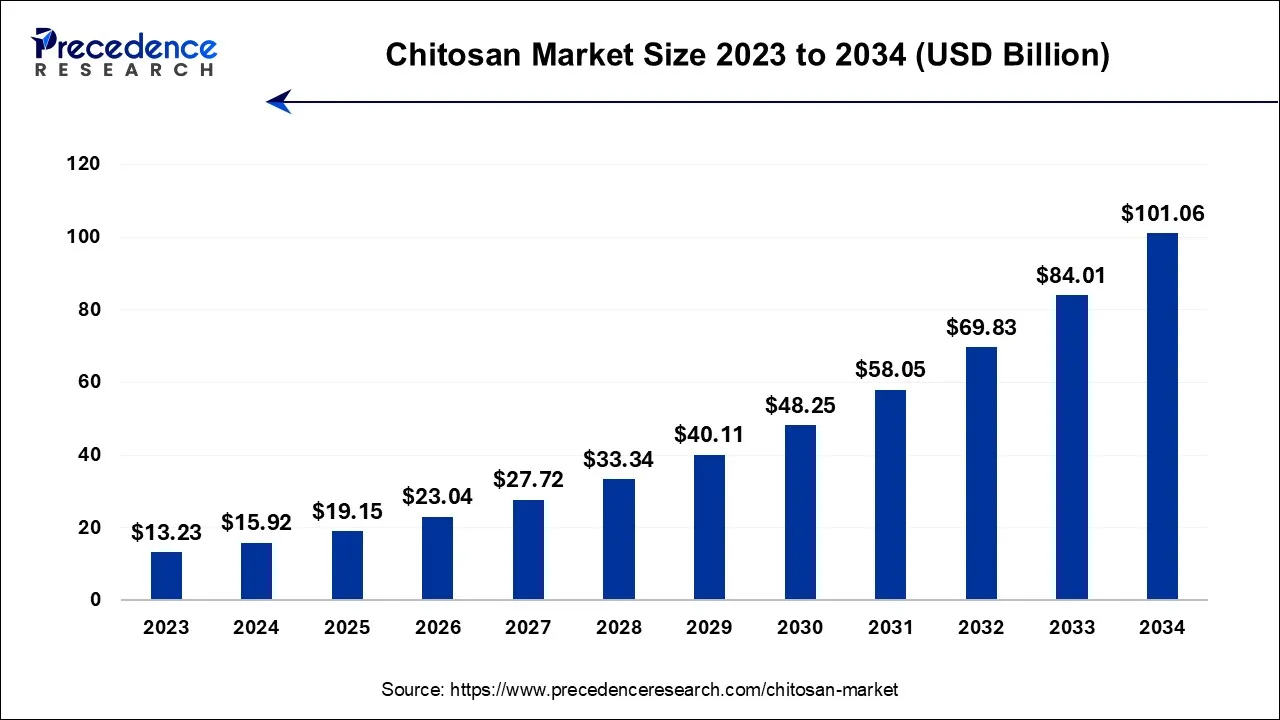

The global chitosan market size is estimated at USD 15.92 billion in 2024 and is expected to be worth around USD 101.06 billion by 2034, growing at a CAGR of 20.29% from 2024 to 2034.

The Chitosan Market is experiencing significant growth, driven by the versatile applications of chitosan in industries such as healthcare, agriculture, food & beverages, water treatment, and cosmetics. Derived from the shells of crustaceans like shrimp and crabs, chitosan is prized for its biodegradability, biocompatibility, and low toxicity. Increasing consumer demand for natural and sustainable ingredients has positioned chitosan as a preferred choice across multiple sectors. In healthcare, for instance, chitosan is used for its anti-microbial, anti-cholesterol, and weight-management benefits, fueling its popularity in nutraceuticals and dietary supplements. The agricultural sector has also adopted chitosan as a biopesticide and plant growth enhancer, which aligns with the shift toward environmentally friendly agricultural practices. The water treatment industry heavily relies on chitosan’s ability to purify water by removing impurities and heavy metals, especially in regions dealing with water contamination issues. with Asia-Pacific leading due to significant chitosan production in countries like Japan, China, and India. However, challenges such as high production costs and seasonal limitations in raw materials exist, though advancements in synthetic chitosan and more efficient extraction methods present opportunities for growth.

Get a Sample: https://www.precedenceresearch.com/sample/1335

Chitosan Market Trends

- Increasing Use in Water Treatment: Chitosan is being increasingly used as a natural coagulant in water treatment processes. Chitosan has shown a reduction of up to 60% in water turbidity and organic load when used in wastewater treatment, promoting its use over synthetic alternatives.

- Growing Demand in Biodegradable Packaging: The biodegradable packaging sector is embracing chitosan for its eco-friendly properties. Studies show that chitosan films can reduce microbial growth by up to 70% compared to conventional plastic packaging, making it a preferred choice in the food packaging industry.

- Advancements in Agricultural Applications: Chitosan is gaining traction in agriculture as a biopesticide and plant growth enhancer. Research highlights a 30% improvement in crop yield when chitosan-based treatments are applied, underscoring its efficacy and adoption in sustainable agriculture practices.

- Rising Popularity in the Cosmetics Industry: The cosmetics sector increasingly incorporates chitosan for its biocompatibility and film-forming properties. With a skin hydration boost of 25% seen in chitosan-based skincare products, demand for it in personal care is growing among brands focused on natural ingredients.

- Development in Pharmaceutical Applications: Chitosan’s use in drug delivery and wound healing is expanding, especially for its antimicrobial and wound-healing properties. Clinical studies indicate that chitosan dressings can reduce wound healing time by up to 50% compared to traditional dressings, which has led to its growing application in the healthcare sector.

- Focus on Dietary Supplements: Chitosan is gaining popularity in dietary supplements, primarily for its ability to bind fats and aid weight management. It is observed that chitosan supplements reduce dietary fat absorption by up to 42%, driving demand among health-conscious consumers.

- Innovation in Nanotechnology: Researchers are exploring chitosan nanoparticles in biomedical applications, as they demonstrate 80% more efficient drug encapsulation and controlled release, compared to conventional methods. This trend is anticipated to fuel interest in chitosan for high-precision medical applications.

- Increase in Research and Development Investments: Companies are investing in R&D to enhance the functional properties of chitosan. Notable advancements include modifications that improve its solubility by 60%, opening up wider applications in industries where solubility has previously been a limitation.

North America led the global Chitosan Market

North America’s dominance in the chitosan market can be attributed to a combination of factors, including advanced research and development (R&D) capabilities, high demand across industries, and supportive government regulations. Here’s a breakdown of the factors driving North America’s leadership in this market:

1. Research and Development Capabilities

- Advanced Biopolymer Research: North American institutions and companies are at the forefront of biopolymer research, which has led to high-quality chitosan products with diverse applications. Academic and private research have unlocked new uses for chitosan in pharmaceuticals, agriculture, and water treatment.

- Collaborative Industry-Academia Partnerships: Partnerships between universities and industries have accelerated innovation in chitosan applications, especially in fields like drug delivery systems and tissue engineering.

- High R&D Expenditure: The U.S. government and private sector combined spend nearly 3% of the GDP on R&D (approximately $708 billion annually as of recent data), facilitating growth in the development of chitosan-based technologies.

2. High Demand Across Key Industries

- Pharmaceutical Industry: Chitosan is used in drug delivery systems, wound dressings, and tissue engineering due to its biocompatibility and non-toxic nature. With the U.S. pharmaceutical market being one of the largest globally, demand for biocompatible materials like chitosan is significant.

- Agriculture: The U.S. agricultural sector has adopted chitosan as a natural pesticide and growth enhancer, aligning with the increasing consumer preference for organic farming solutions.

- Water Treatment: The U.S. Environmental Protection Agency (EPA) endorses the use of chitosan in water treatment due to its natural flocculant properties, making it a safe option for filtering out impurities and contaminants.

3. Supportive Government Regulations and Policies

- FDA and EPA Approvals: The U.S. Food and Drug Administration (FDA) and the EPA have approved chitosan for use in food, pharmaceuticals, and agriculture, encouraging companies to invest in its production and innovation.

- Environmental Initiatives: Chitosan, derived from shrimp shells, aligns with sustainability goals and waste reduction strategies encouraged by North American governments. Canada and the U.S. have provided grants and tax incentives for companies developing environmentally friendly products.

- Funding and Grants: The U.S. government has provided funding for projects aimed at promoting chitosan in biomedicine and water treatment, fostering market growth.

4. Increasing Health and Wellness Awareness

- Rise in Organic and Natural Product Demand: There is a rising consumer demand for organic, sustainable, and natural products in North America. This demand is particularly notable in dietary supplements and personal care products, where chitosan is used for its natural composition and health benefits.

5. Strong Supply Chain and Logistics

- Infrastructure and Supply Chains: The advanced infrastructure in North America supports a smooth supply chain for chitosan from raw material sourcing to final production. This efficiency aids in cost-effective production and rapid market penetration.

Below is a summary table highlighting these factors:

| Factor | Description | Statistical/Quantitative Data |

|---|---|---|

| Research and Development Capabilities | High investment in biopolymer research, partnerships, and innovation | $708 billion spent annually on R&D in the U.S. |

| Pharmaceutical Demand | Widespread use of chitosan in drug delivery, wound care, and tissue engineering | U.S. pharma market: largest globally with extensive chitosan applications |

| Agricultural Applications | Utilized as a natural pesticide and growth enhancer | Organic agriculture market growing at 10% annually in North America |

| Water Treatment Endorsement | EPA support for chitosan in water treatment | Endorsement by the EPA for eco-friendly treatment options |

| Supportive Government Policies | FDA and EPA approvals, grants, and tax incentives for chitosan development | Numerous grants and funding initiatives by U.S. and Canadian governments |

| Health and Wellness Trends | Growing consumer preference for organic and natural products in personal care and dietary supplements | Organic market value in the U.S. exceeds $60 billion |

| Supply Chain and Logistics | Well-developed infrastructure enabling cost-effective production and efficient distribution | North America: significant logistics hubs and efficient supply cha |

Read Also: Green Hydrogen Market Size to Surpass USD 165.84 Bn by 2033

Chitosan Market Growth in India’s Agriculture Sector (2022-2024)

Key Developments

- Government Support: Initiatives by the Indian government promoted organic and sustainable farming. The Indian Ministry of Agriculture emphasized bio-fertilizers, boosting chitosan’s visibility as a natural alternative to chemical pesticides.

- Market Growth: The agriculture sector drove demand, with compound annual growth rates (CAGR) around 15% for chitosan products in bio-pesticides and plant growth enhancement. In 2023, demand further rose due to campaigns promoting organic farming.

- Collaborations: Indian agricultural companies collaborated with biotech firms to develop chitosan-based formulations, focusing on yield improvement and crop disease resistance.

Challenges

High production costs of chitosan and dependence on imports for raw materials limited market expansion. Efforts to source crustacean waste locally and streamline processing techniques were undertaken to manage costs.

Web: https://www.precedenceresearch.com/