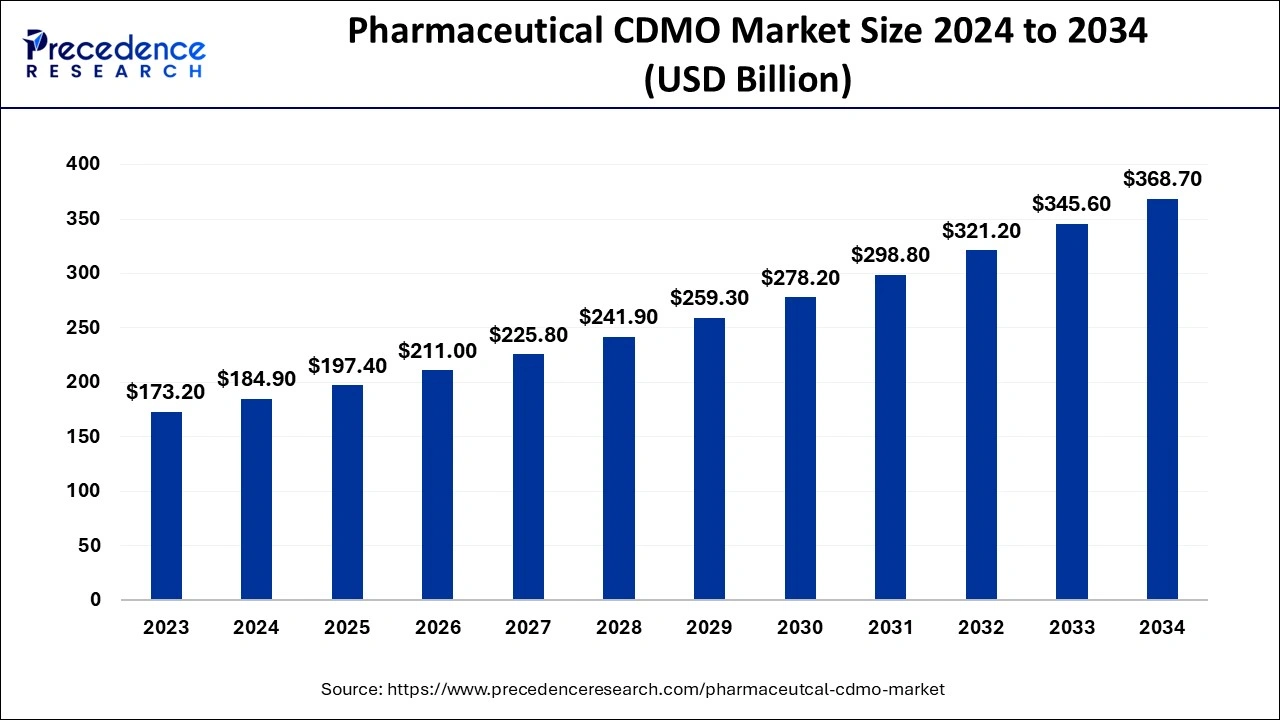

The global pharmaceutical CDMO market size is estimated at USD 184.9 billion in 2024, and is projected to reach around USD 345.6 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

The Pharmaceutical Contract Development and Manufacturing Organization (CDMO) Market is a rapidly expanding sector, driven by pharmaceutical companies’ increasing need for outsourcing drug development and production. CDMOs offer end-to-end services from early-stage drug development through clinical trials to commercial-scale manufacturing, which allows pharmaceutical companies to reduce costs, streamline operations, and accelerate time-to-market. Factors like rising demand for biologics, increasing drug approvals, and the need for specialized manufacturing capabilities have fueled the growth of CDMOs. Additionally, the global push for new therapies and personalized medicines is expanding the demand for CDMO services, as these organizations often possess the advanced technologies required to produce complex and high-quality drug products. Enhanced by regulatory compliance expertise and scalability, CDMOs are essential in supporting pharmaceutical firms’ strategies, particularly as the industry grows more competitive and complex.

Get a Sample: https://www.precedenceresearch.com/sample/2936

Pharmaceutical CDMO Market Trends

- Increasing Biologics Demand: Biologics are driving significant growth in the CDMO market, with nearly 40% of the pharmaceutical pipeline consisting of biologics. This demand is pushing CDMOs to expand capabilities for advanced biologics production, including cell and gene therapies, monoclonal antibodies, and mRNA-based products.

- Rise in Outsourcing for Small and Mid-Sized Companies: Over 70% of small and mid-sized pharmaceutical companies lack in-house manufacturing capabilities, leading them to rely heavily on CDMOs for development and production. This trend is prompting CDMOs to enhance specialized, flexible manufacturing capabilities to cater to smaller batch sizes and unique project needs.

- Increase in Drug Development for Rare Diseases: More than 7,000 rare diseases lack effective treatments, fueling a surge in orphan drug development and specialized manufacturing. CDMOs are investing in niche technologies to support rare and orphan drug pipelines, which now make up approximately 20% of all drug development projects.

- Focus on Integrated Services: About 60% of clients prefer end-to-end services in drug development and manufacturing, prompting CDMOs to integrate services ranging from R&D to commercial manufacturing. This approach reduces time-to-market and appeals to clients looking for streamlined, single-partner solutions.

- Adoption of Single-Use Technology (SUT): Single-use technology has seen a 25% year-over-year growth in adoption due to its cost-efficiency and reduced contamination risk. It is particularly prevalent in biologics manufacturing, where CDMOs are shifting to modular and flexible facilities incorporating SUT.

- Expansion of Manufacturing Capacity in Asia: Asia-Pacific CDMO capacity has grown by over 15% in recent years, with increasing investment in countries like China and India. This region’s cost advantages and skilled workforce are attracting global clients, contributing to a substantial portion of outsourcing projects.

- Digital Transformation and Data Integration: Around 30% of CDMOs are implementing advanced digital tools and data analytics to optimize production, monitor quality, and enable predictive maintenance. This digital transformation is expected to improve production efficiency by 20–25%, helping CDMOs stay competitive.

- Growth in API Manufacturing for High-Potency Drugs: The demand for high-potency active pharmaceutical ingredients (HPAPIs) has risen by over 10%, driven by oncology and central nervous system (CNS) treatments. CDMOs are expanding containment capabilities and upgrading facilities to handle HPAPI production safely and efficiently.

- Sustainability Initiatives: With sustainability becoming a priority, over 50% of CDMOs are adopting greener practices, such as energy-efficient equipment, water conservation, and waste reduction. Clients are increasingly favoring CDMOs with clear environmental, social, and governance (ESG) goals.

- Expansion of Cell and Gene Therapy Capabilities: Cell and gene therapy manufacturing projects have increased by 20% as the demand for innovative therapies grows. CDMOs are investing in specialized infrastructure and technology to support these therapies, which require complex and precise manufacturing environments.

Asia-Pacific holds the largest market in 2023

Asia Pacific’s dominance in the Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market can be attributed to several factors, including government support, cost advantages, technological advancements, and the presence of a skilled workforce. Below, I’ll provide an explanation and a table summarizing the key points.

1. Cost Efficiency and Skilled Labor

- The Asia Pacific region, particularly India and China, offers significant cost advantages due to lower labor and manufacturing costs compared to Western countries. This cost-effectiveness makes it attractive for outsourcing pharmaceutical manufacturing.

- A large pool of skilled labor, including scientists, engineers, and technicians, further contributes to the region’s CDMO strength. As of recent estimates, China and India alone account for over 20% of the world’s pharmaceutical and biotech workforce.

2. Robust Infrastructure and Technological Advancements

- Asia Pacific countries have invested in infrastructure improvements to attract and support CDMO activities. For example, China’s “Made in China 2025” initiative and India’s “Pharma Vision 2020” aim to boost domestic manufacturing capabilities and encourage foreign investments.

- Technology adoption in Asia is increasing, with more CDMOs in the region adopting cutting-edge solutions such as single-use bioreactors, continuous manufacturing, and advanced analytical tools.

3. Supportive Government Policies and Investments

- Governments across Asia Pacific offer various incentives to support the pharmaceutical CDMO market. For instance, China provides tax incentives and subsidies to pharmaceutical firms engaged in R&D and manufacturing, while Japan has relaxed some regulations to expedite pharmaceutical development.

- India, through initiatives like the Production Linked Incentive (PLI) scheme, has set aside funds to boost the domestic pharmaceutical manufacturing sector, with an estimated $2 billion dedicated to API (active pharmaceutical ingredient) production.

4. Increasing Demand for Pharmaceuticals

- Asia Pacific’s large population and rising healthcare needs have driven demand for pharmaceuticals, encouraging both local and foreign firms to establish CDMO operations in the region.

- The region also sees a growing demand for biologics and complex drugs, which has spurred CDMO investments in specialized facilities and capabilities. The demand for biologics in Asia is estimated to grow by over 8% annually, indicating a steady increase in specialized manufacturing requirements.

5. Rising Foreign Investments

- In 2023, foreign direct investment (FDI) in the pharmaceutical sector across Asia Pacific grew by over 15%, as companies seek to capitalize on the region’s cost advantages and growth potential. Western companies, including Pfizer and Novartis, have been establishing partnerships with Asian CDMOs to leverage their capabilities.

- Japan, for example, has increased its pharmaceutical FDI incentives, resulting in a 20% year-over-year increase in investments in 2023.

Summary Table: Key Factors Contributing to Asia Pacific’s Dominance in the Pharmaceutical CDMO Market

| Factor |

Description |

Example Statistics / Data |

| Cost Efficiency and Skilled Labor |

Lower labor and operational costs, coupled with a skilled workforce. |

India and China account for 20%+ of the global pharmaceutical workforce. |

| Infrastructure and Technology |

Advanced manufacturing infrastructure and technological adoption. |

China’s “Made in China 2025” and India’s “Pharma Vision 2020” promote pharmaceutical manufacturing and tech adoption. |

| Government Policies and Support |

Subsidies, tax incentives, and supportive regulatory frameworks. |

India’s PLI scheme for pharmaceuticals with $2 billion allocated for API manufacturing. |

| Increasing Pharmaceutical Demand |

High demand for drugs and biologics driven by a large population and rising healthcare needs. |

Biologics demand in Asia expected to grow at over 8% annually, fueling CDMO investments. |

| Rising Foreign Investments |

Increased FDI due to market potential and cost advantages. |

FDI in Asia Pacific’s pharma sector grew by 15% in 2023; Japan saw a 20% increase in pharma investments year-over-year. |

Read Also: Chitosan Market Size to Surpass USD 101.06 Billion by 2034

Case Study: Expansion of Indian Pharmaceutical CDMO – Syngene International (2022-2024)

Key Strategies and Developments (2022-2024)

- Facility Expansion

In 2022, Syngene inaugurated a new active pharmaceutical ingredient (API) manufacturing facility in Mangalore, India, to increase its production capacity. This facility added significant API capabilities to serve international clients and meet Good Manufacturing Practices (GMP) standards.

- Investment in Biologics

In 2023, Syngene invested in expanding its biologics production facility to meet the demand for biologics and biosimilars. This was in response to increased biologics outsourcing, as many global pharma companies looked for cost-effective biologics manufacturing solutions.

- Collaborations and Partnerships

Between 2022 and 2024, Syngene secured several partnerships with U.S.-based pharma companies. Notably, a significant collaboration with Bristol Myers Squibb allowed Syngene to provide end-to-end solutions, from development to large-scale production, which strengthened its position in high-value, long-term contracts.

- Regulatory Compliance and Certifications

To align with international standards, Syngene upgraded its quality assurance and regulatory compliance processes. In 2024, it received regulatory approvals from the U.S. FDA and European authorities for multiple facilities, making it a trusted CDMO partner for regulated markets.

Recent activity in the Pharmaceutical Contract Development and Manufacturing Organization (CDMO) industry

- Agilent Technologies and BIOVECTRA: Agilent Technologies completed its acquisition of BIOVECTRA in September 2024. This deal enhances Agilent’s capabilities in biomanufacturing and drug development, particularly for specialized therapies, potentially streamlining processes for clients and expanding production options for advanced therapeutic products.

- Catalent and Novo Holdings: Catalent is in the process of being acquired by Novo Holdings for $16.5 billion. This acquisition reflects Novo’s strategy to strengthen its CDMO capabilities, especially in fill-finish production, a crucial service for injectable therapies. Following the acquisition, three of Catalent’s facilities will be transferred to Novo Nordisk, marking a significant restructuring of resources within the CDMO space.

- Samsung Biologics: Samsung Biologics signed a substantial $1.068 billion biologics manufacturing contract with a U.S. pharmaceutical company in mid-2024, continuing its expansion in global biomanufacturing. This follows earlier partnerships with Seoul National University, which aim to attract top talent and support high-demand fields like cell and gene therapies.

- WuXi Biologics and Medigene: WuXi Biologics announced a strategic partnership with Medigene to co-develop T-cell-receptor-guided T-Cell Engagers, a cutting-edge approach in immuno-oncology. WuXi’s growing focus on emerging therapies, particularly for oncology applications, underscores the CDMO’s role in advancing personalized medicine.

Web: https://www.precedenceresearch.com