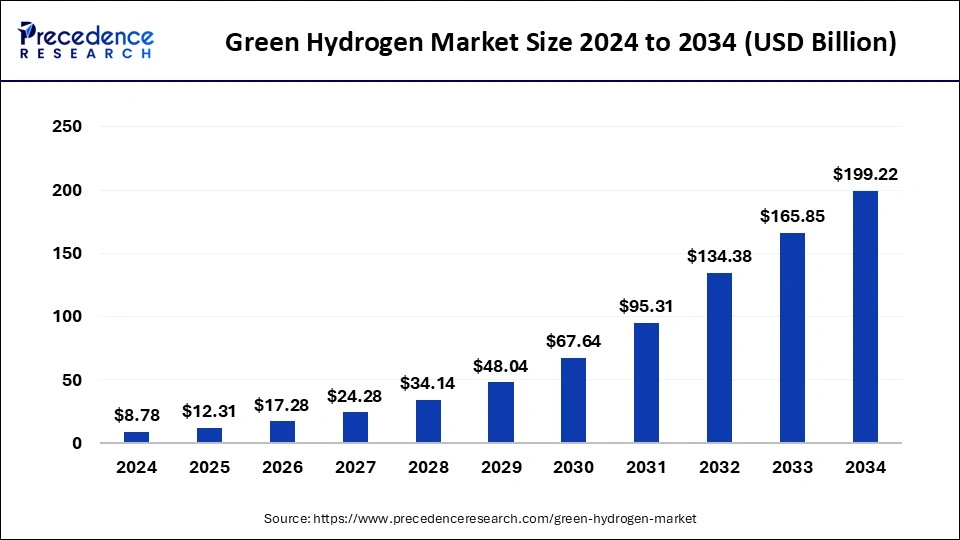

The global green hydrogen market size reached USD 8,78 billion in 2024 and is projected to surpass around USD 165.84 billion by 2033, poised to grow at a CAGR of 38.77% from 2024 to 2033.

Green Hydrogen Market Overview

The green hydrogen market is on a promising growth trajectory, fueled by strong global momentum to reduce carbon emissions and transition to renewable energy solutions across transportation, industry, and power generation. Valued at approximately $1 billion, the market is expected to expand rapidly, supported by breakthroughs in electrolyzer technology that make production more efficient and cost-effective. Leading regions like Europe, North America, and Asia-Pacific are setting the pace, with ambitious national hydrogen strategies in countries such as Germany and France. With falling renewable energy costs and increasing government incentives, green hydrogen is emerging as a commercially viable, eco-friendly solution poised to transform energy-intensive sectors and accelerate progress toward a sustainable, carbon-neutral future.

Green Hydrogen Market Trends

- Increased Investment in Production Projects:

- Over 680 large-scale hydrogen projects were announced globally by early 2024, with a total estimated investment of around $240 billion, highlighting significant financial commitment to green hydrogen initiatives.

- Electrolyzer Capacity Expansion:

- Global electrolyzer capacity is expected to rise rapidly, from 0.3 GW in 2021 to over 54 GW by 2030, as companies and governments invest in scaling up hydrogen production infrastructure.

- Cost Reduction in Electrolyzers:

- Cost of electrolyzers has decreased by 60% over the last decade, due to technological advances and economies of scale, with further reductions anticipated, potentially making green hydrogen cost-competitive by 2030.

- Renewable Energy-Powered Hydrogen Production:

- Over 85% of new green hydrogen projects planned use renewable energy sources, particularly wind and solar, to power electrolyzers, reflecting a move towards sustainable hydrogen production.

- Hydrogen-Powered Transportation Initiatives:

- Many countries are adopting hydrogen fuel cell vehicles for public transportation. Japan, for instance, aims to increase its hydrogen-powered fuel cell vehicle fleet to 200,000 units by 2025.

- Policy Support and Incentives:

- Approximately 20 countries have released national hydrogen strategies, offering policy support, subsidies, and incentives to promote green hydrogen. The EU, for instance, allocated €430 million to hydrogen projects in 2022.

- Growing Hydrogen Pipeline Infrastructure:

- Europe has plans to develop over 23,000 km of hydrogen pipelines by 2040, connecting various countries for efficient hydrogen transport across borders, thus enhancing the global hydrogen network.

- Carbon Emission Reduction Targets:

- Green hydrogen has the potential to reduce carbon emissions by approximately 830 million metric tons annually by replacing fossil fuels, especially in hard-to-decarbonize sectors like steel and cement production.

- Hydrogen as a Backup for Renewable Energy:

- Green hydrogen is increasingly being used as a storage solution for renewable energy, as it can be stored and reconverted to electricity, addressing the intermittency issues of solar and wind power sources.

Asia Pacific’s Green Hydrogen Market Dominated in 2023

Asia Pacific’s dominance in the Green Hydrogen market is driven by a combination of government initiatives, strategic investments, and the region’s vast renewable energy potential. Many countries in Asia Pacific have aggressive goals for carbon reduction, energy diversification, and renewable energy production, aligning closely with green hydrogen’s capabilities as a clean energy source. Here’s a breakdown of the factors supporting this market leadership:

Factors Contributing to Asia Pacific’s Green Hydrogen Market Dominance

- Government Support and Policy Initiatives

- Japan: Japan aims to be a leader in hydrogen technology, allocating over $19 billion to support hydrogen fuel production and technology development, with targets to establish over 10,000 hydrogen refueling stations by 2030.

- China: China’s Hydrogen Strategy promotes hydrogen as a critical component of its carbon-neutral goals. The government has invested heavily, setting targets to produce 100,000 hydrogen fuel cell vehicles by 2025.

- Australia: Australia has allocated A$1.4 billion toward its National Hydrogen Strategy, with several green hydrogen projects aimed at supplying domestic and international demand.

- Abundant Renewable Energy Sources

- The Asia Pacific region benefits from an abundance of renewable resources essential for green hydrogen production, including solar, wind, and hydro power:

- China: Leads globally in solar energy production, contributing approximately 220 GW of installed capacity.

- India: With over 150 GW of renewable energy installed, India aims to increase this to 450 GW by 2030 and use this power to produce green hydrogen.

- Australia: Known for vast solar and wind energy potential, with projects like the Asian Renewable Energy Hub planned to produce up to 3.5 million tons of green hydrogen annually.

- The Asia Pacific region benefits from an abundance of renewable resources essential for green hydrogen production, including solar, wind, and hydro power:

- Decreasing Renewable Energy Costs

- The rapid decline in renewable energy costs has made green hydrogen production more economically feasible:

- Solar energy costs in India are among the world’s lowest, with prices dropping to $0.03 per kWh, favoring affordable hydrogen production.

- Countries across Asia Pacific see decreasing costs in wind and solar installations, bringing down green hydrogen production costs to an estimated $2–$4/kg.

- The rapid decline in renewable energy costs has made green hydrogen production more economically feasible:

- Private Sector Investments and Strategic Partnerships

- Investment from private companies in Asia Pacific plays a significant role, with collaborative efforts aimed at scaling hydrogen production:

- South Korea’s Hyundai has committed to producing 500,000 hydrogen-powered vehicles annually by 2030.

- Reliance Industries in India announced a commitment to invest $10 billion in green hydrogen production by 2030, aiming to reach 1 kg production cost for green hydrogen.

- China’s State Grid Corporation and Sinopec have substantial green hydrogen projects, including dedicated solar and wind installations to produce green hydrogen.

- Investment from private companies in Asia Pacific plays a significant role, with collaborative efforts aimed at scaling hydrogen production:

- Export Potential and Regional Trade Agreements

- Asia Pacific countries aim to position themselves as exporters of green hydrogen to meet international demand:

- Australia: Planning to export green hydrogen to Japan, South Korea, and Singapore, supported by trade agreements and partnerships.

- Japan and South Korea are key importers with advanced hydrogen infrastructures, creating a high-demand environment for green hydrogen from nearby producers.

- Asia Pacific countries aim to position themselves as exporters of green hydrogen to meet international demand:

Read Also: Artificial Intelligence (AI) Robots Market Size to Hit USD 124.26 Bn by 2034

Green Hydrogen Market Information in Asia Pacific

| Factor | Details | Key Statistics |

|---|---|---|

| Government Support | Robust policies, incentives, and funding by countries like Japan, China, Australia | Japan: $19 billion allocated; China: 100,000 fuel cell vehicles by 2025 |

| Renewable Energy Sources | Abundance of solar, wind, and hydro energy in the region supporting green hydrogen production | China: 220 GW solar; India: 450 GW renewable target by 2030; Australia: 3.5 million tons output |

| Declining Renewable Costs | Decrease in renewable energy production costs aids in affordable hydrogen production | India solar cost: $0.03 per kWh; Green hydrogen production cost in APAC: $2–$4/kg |

| Private Sector Investment | Significant contributions from major companies toward hydrogen production infrastructure | Hyundai: 500,000 hydrogen vehicles; Reliance: $10 billion investment by 2030 |

| Export and Trade Agreements | Asia Pacific countries establishing export capabilities, especially to Japan and South Korea | Australia exporting to Japan & S. Korea; Japan and S. Korea high demand for imported hydrogen |

Case Study: Reliance Industries’ Green Hydrogen Initiative (2022-2024)

Project Highlights:

- Objective: To produce green hydrogen at a competitive cost of below $1/kg by 2030, leveraging renewable energy sources, particularly solar and wind.

- Investment: Reliance announced a $10 billion investment over three years, beginning in 2022, focused on developing green hydrogen production, storage, and distribution infrastructure.

- Technology: The project includes electrolyzer manufacturing, solar photovoltaic (PV) panels, and advanced energy storage solutions to enhance efficiency.

- Strategic Partnerships: Collaborations with companies like Stiesdal A/S (Danish technology provider) for electrolyzer technology and Ambri (US-based energy storage company) to develop battery technology for energy storage.

Outcomes (as of 2024):

- Pilot Success: Reliance successfully conducted pilot projects producing green hydrogen in Jamnagar, yielding data on efficiency, costs, and scalability.

- Cost Reduction Milestones: Initial results indicate a pathway to achieving a lower cost per kg of hydrogen, with further potential as technology matures and scale increases.

- Environmental Impact: The project is anticipated to cut approximately 2 million tons of CO₂ emissions annually by 2030, contributing significantly to India’s renewable energy goals.

Competitive landscape

The green hydrogen market is witnessing significant growth in investment, collaboration, and corporate initiatives as countries and companies strive for a low-carbon future. A notable trend is the surge in project investments, with companies like Linde and BP advancing green hydrogen projects in regions such as the U.S. and Europe. In 2024, the committed capital for global hydrogen projects, especially those reaching the Final Investment Decision (FID), soared to around $75 billion, highlighting the sector’s growth despite challenges like inflation and regulatory uncertainties. This investment surge reflects a strategic shift from planning to project execution, with major growth seen in advanced project stages