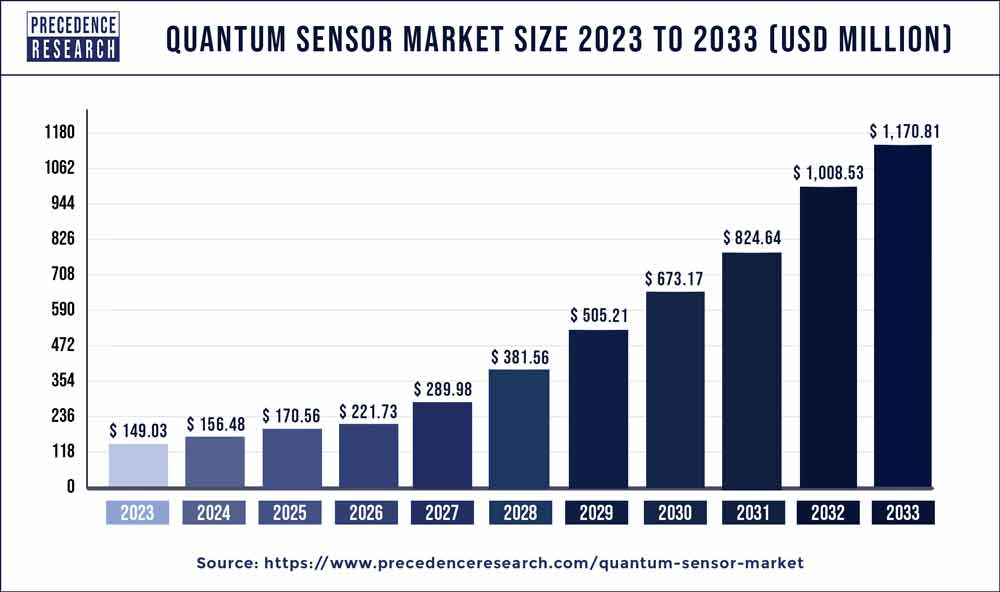

The global quantum sensor market size reached USD 149.03 million in 2023 and is projected to surpass around USD 1,170.81 million by 2033 with a CAGR of 25.06% from 2024 to 2033.

- Growing Adoption in Defense & Aerospace: Quantum sensors are increasingly being utilized for precise navigation systems, gravitational field mapping, and detecting submarines. The defense sector is adopting quantum technologies for improved accuracy in operations, especially in GPS-denied environments.

- Quantum Gravimeters for Geophysical Applications: Quantum gravimeters, which measure gravitational fields with high precision, are being integrated into geological surveys, oil exploration, and natural resource mapping. These instruments are revolutionizing how subsurface resources are detected.

- Advancements in Quantum Magnetometers: Quantum magnetometers are witnessing rapid improvements, with applications in healthcare (MRI enhancements), military, and environmental monitoring. These devices offer ultra-sensitive detection of magnetic fields and are valuable for non-invasive diagnostics.

- Integration in Autonomous Vehicles: Quantum sensors are being tested for use in autonomous vehicles, offering more precise navigation and motion detection compared to conventional sensors. Companies are exploring their use for enhancing vehicle safety systems.

- Growth in Quantum Sensing for Medical Imaging: Research and development in quantum-enhanced medical imaging technologies, such as magnetic resonance imaging (MRI) and biomagnetic sensing, are on the rise. These innovations are expected to provide clearer images and earlier detection of diseases, improving diagnostic accuracy.

- Increased Investment in Research: Governments and private entities are significantly investing in quantum sensor research. The European Union’s Quantum Flagship initiative, for example, allocated over €1 billion for quantum technology research, including quantum sensors, over a decade.

- Emergence of Quantum Sensors in Space Exploration: Space agencies are increasingly adopting quantum sensors for space missions. Quantum gyroscopes and accelerometers are being used for precise positioning in space, providing data critical for deep space exploration and satellite deployment.

- Environmental Monitoring: Quantum sensors are being developed for environmental applications such as monitoring climate change, oceanography, and pollution tracking. These sensors are capable of detecting minute changes in temperature, pressure, and magnetic fields, making them invaluable for environmental studies.

- Advances in Quantum Communication Security: Quantum sensors are playing a crucial role in quantum communication technologies, enhancing secure data transmission through quantum cryptography. This trend is being explored for both commercial and government use.

- Technological Collaborations: There is a growing number of collaborations between academic institutions, government agencies, and technology companies to advance quantum sensor technologies. This collaboration aims to fast-track the development and commercialization of practical quantum sensor applications.

- Commercialization of Quantum Accelerometers: Quantum accelerometers, which offer highly accurate motion detection without relying on external signals like GPS, are increasingly being commercialized, especially in sectors like aerospace, defense, and marine exploration.

Read Also: Portable Solar Panel Market Size to Surpass USD 7.37 Bn by 2034

North America Dominated the Quantum Sensor Market

North America’s dominance in the quantum sensor market can be attributed to several key factors such as advanced research, strong government support, high technological capabilities, a robust industrial base, and collaborations between academic institutions and private companies. The region has leveraged its established quantum technology ecosystem to foster growth in quantum sensors for applications ranging from military and defense to healthcare and telecommunications.

Factors Contributing to North America’s Dominance in Quantum Sensor Market

1. Advanced Research and Development

- The U.S. and Canada host some of the world’s top research institutions and universities, such as MIT, Harvard, and the University of Toronto, that are heavily involved in quantum technology research.

- Significant funding is being directed toward quantum computing and sensing technologies, with U.S. government agencies like DARPA, NASA, and the National Science Foundation (NSF) leading groundbreaking research.

2. Strong Government Support

- National Quantum Initiative Act (2018) in the U.S. authorized $1.2 billion in federal funding over five years for quantum research, with a large portion allocated for quantum sensors.

- The U.S. Department of Defense (DoD) has been a strong advocate for quantum sensing technologies for precision navigation and timing in GPS-denied environments.

- The Canadian government, through Innovation, Science and Economic Development (ISED), committed CAD 360 million to support quantum technology research between 2021 and 2025.

3. Private Sector and Academic Collaborations

- Companies such as IBM, Microsoft, and Rigetti Computing are leading the commercial application of quantum technology and have developed partnerships with national labs and universities.

- For example, IBM’s Quantum Network involves collaborations with more than 150 organizations across North America to develop quantum technologies, including sensors.

- Strong industry-academic collaboration has enabled rapid translation of R&D into commercial applications, pushing North America ahead in innovation and deployment.

4. Military and Defense Applications

- Quantum sensors are seen as a critical component in the defense sector for applications such as submarine detection, precision navigation, and radar systems.

- The U.S. military is exploring quantum-enhanced inertial sensors that can outperform traditional gyroscopes and accelerometers, improving navigation in GPS-denied environments.

- The DoD allocated more than $30 million in 2023 toward the development of quantum sensing technologies specifically for national security purposes.

5. High Demand in Aerospace and Healthcare

- North America has a robust aerospace sector, and quantum sensors are being explored for applications in satellite positioning systems, enhanced imaging, and communication technologies.

- Quantum sensors have potential applications in healthcare, particularly in imaging techniques like MRI. Research conducted by Quantum Imaging has shown the ability of quantum sensors to significantly improve imaging quality and reduce radiation exposure.

Government Funding and Investments

| Program/Agency | Country | Year | Amount (USD) | Purpose/Focus |

|---|---|---|---|---|

| National Quantum Initiative Act | U.S. | 2018 | $1.2 billion | To advance research and development in quantum technologies, including quantum sensors |

| Department of Defense (DoD) | U.S. | 2023 | $30 million | For quantum sensing technologies in defense and national security |

| Innovation, Science and Economic Dev. | Canada | 2021-2025 | CAD 360 million | For quantum technology research with a focus on sensors and computing |

| Quantum Leap Challenge Institutes | U.S. | 2020 | $25 million | Funding for academic and industrial research collaborations in quantum sensing |

| DARPA | U.S. | Ongoing | Classified, ongoing | Focus on next-generation quantum sensors for military applications |

Industry and Collaboration Efforts

| Company/Organization | Initiative/Collaboration | Sector | Key Contributions/Focus |

|---|---|---|---|

| IBM Quantum Network | Partnership with universities and private firms | Computing/Healthcare | Quantum computing and sensor integration for industrial applications |

| Microsoft | Collaboration with National Quantum Initiative | Computing/Defense | Focus on quantum sensing technologies for data security and navigation |

| Honeywell | Quantum sensor R&D for industrial applications | Defense/Aerospace | Development of high-precision quantum sensors for navigation and defense systems |

| Rigetti Computing | Partnership with research institutions | Computing | Commercial applications of quantum sensors for high-speed data processing |

6. Favorable Regulatory Environment

- North America has fostered a regulatory environment conducive to innovation. Agencies such as the Federal Communications Commission (FCC) and the National Institute of Standards and Technology (NIST) play an active role in supporting the safe and standardized development of quantum technologies, including sensors.

Case Study: Development and Implementation of Quantum Sensors in India (2022-2024)

Key Players

- Indian Institute of Science (IISc): A leading research institution focusing on quantum technology.

- Tata Advanced Systems: A private firm specializing in defense technologies.

- QNu Labs: A startup focused on quantum cryptography and sensing solutions.

Timeline and Milestones

- 2022:

- Research and Development Initiatives: IISc launched a project aimed at developing a portable quantum gravimeter for geological surveys and urban planning. Initial funding was provided by the Indian government under the Quantum Technology Mission.

- 2023:

- Prototyping and Testing: The prototype of the quantum gravimeter was tested in various locations across India, including seismic zones, to assess its capabilities in detecting subsurface structures.

- Industry Collaboration: Tata Advanced Systems partnered with IISc to integrate quantum sensors into existing defense systems, focusing on applications in navigation and surveillance.

- 2024:

- Commercial Deployment: The quantum gravimeter was commercially launched, with applications in mining and infrastructure development. The device demonstrated a 10-fold improvement in sensitivity over classical sensors.

- Market Expansion: QNu Labs introduced a quantum-enhanced magnetometer for environmental monitoring, gaining traction in industries concerned with pollution control and resource management.

Impact

- Economic Growth: The deployment of quantum sensors led to improved efficiency in resource management and urban planning, contributing to economic growth.

- Research Advancement: Enhanced capabilities in precision measurement spurred further research in quantum technologies, fostering innovation and attracting investment in India’s technology sector.