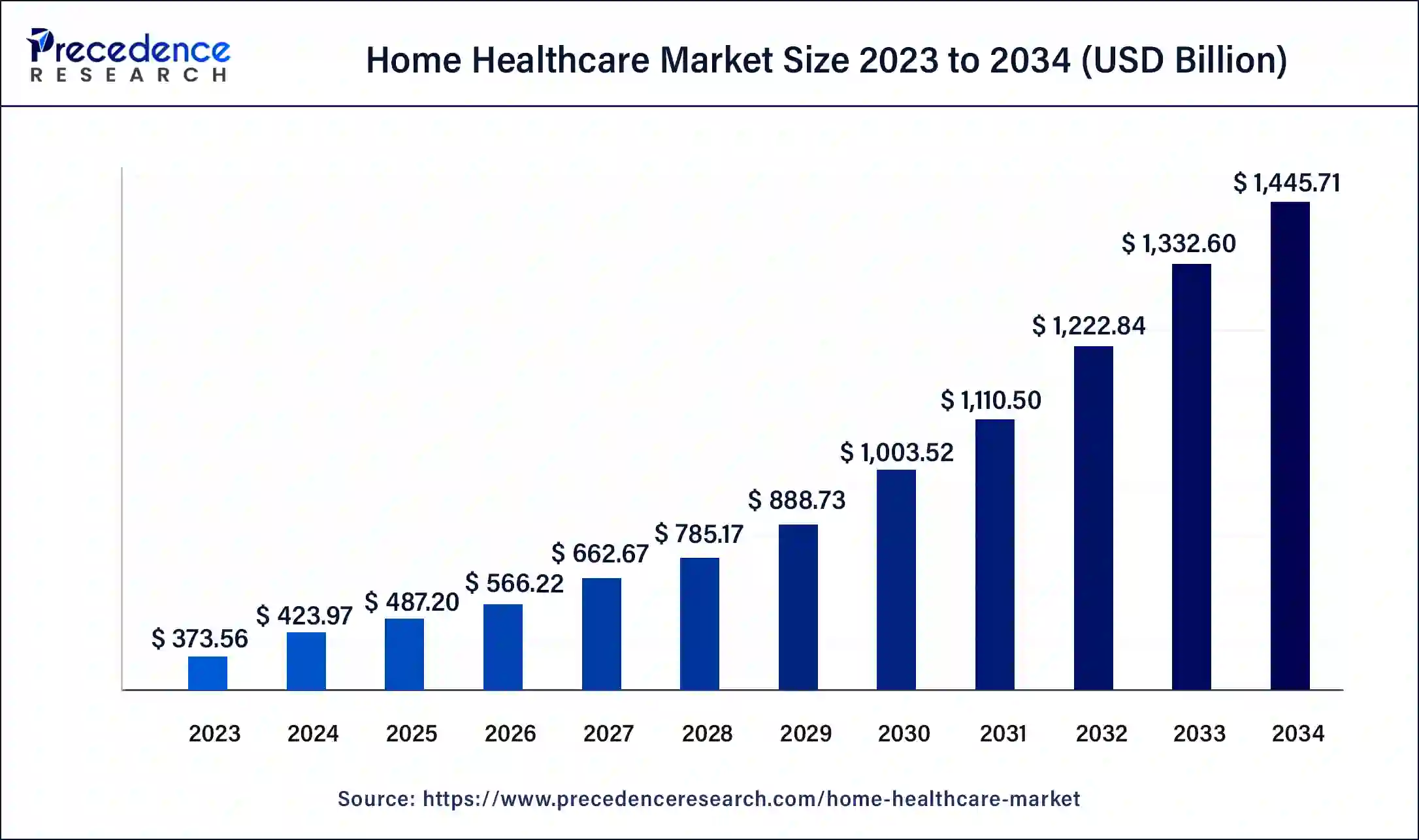

The global home healthcare market size is estimated at USD 423.97 billion in 2024 and is projected to surpass around USD 1,445.71 billion by 2034, growing at a CAGR of 13.05% from 2024 to 2034.

The home healthcare market is driven by the rising prevalence of chronic disorders and the increasing awareness about self-care. Home healthcare is supportive medical care provided in the individual patient’s home to foster wellness and reduce recurring hospital visits. Home healthcare encompasses various services, such as nursing care, physiotherapy, speech therapy, patient education, and diagnostic services.

Home healthcare has several advantages for patients and their families, including cost savings, continuity of care, enhanced patient comfort, and specialized services for patients with cognitive impairment. It enhances patient safety and prevents complications arising due to re-admission. The demand for home healthcare services is increasing rapidly due to the rising treatment costs, contributing to the market expansion.

Key Insights

- North America has accounted revenue share of around 50.59% in 2023.

- The U.S. home healthcare market is growing at a CAGR of 12.74% from 2024 to 2034.

- Based on type, the services segment has accounted highest revenue share of 84.07% in 2023.

- Based on device, the home mobility assist devices segment has generated revenue share of around 40.26% in 2023.

- Based on service, the rehabilitation segment has held revenue share of around 44.12% in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/1190

Regional Stance

North America dominated the home healthcare market with the largest share in 2023, owing to governments’ efforts to cut healthcare costs and the availability of reimbursement policies for home healthcare. Regional market players are adopting business development strategies, such as acquisitions and mergers, to develop and launch a wide range of medical devices and services for home-based care. Moreover, the increasing incidences of chronic diseases and the growing number of geriatric people in the region also contributed to the market growth.

- According to the U.S. Census Bureau’s predictions, the number of Americans ages 100 or above will increase by fourfold in the next thirty years. The current figure is 101,000 in 2024 and is expected to reach 422,000 in 2054.

The market in Asia Pacific is expected to expand at the fastest CAGR in the coming years. The growth of the home healthcare market in the region is attributed to several factors, including the significant rise in the aging population, the rise in the instances of chronic diseases, increasing healthcare costs, and technological advancements. Home healthcare services comprise nursing care services, occupational therapy services, physical therapy services, renting of medical equipment, and home infusion services. Home healthcare, considering a spectrum of in-home lifestyle support services and care that includes medication administration and continuous monitoring, is important in managing chronic diseases such as diabetes, heart-related conditions, and respiratory diseases, among others.

Type Insights

The services segment led the market with the largest share in 2023. Home-based healthcare services include nursing services, physiotherapy, occupational therapy, speech therapy, medical social work services, home health aide, and mobility services that are provided to patients in their respective homes. These services are carried out by skilled personnel. They improve end-of-life care and reduce the risk of hospitalization. Rising spending on healthcare is a key factor contributing to segmental dominance.

Device Insights

Home Healthcare Market, By Device, 2020-2023 (USD Billion)

| By Device | 2020 | 2021 | 2022 | 2023 |

| Diagnostic & Monitoring Devices | 12,638.8 | 14,368.0 | 16,403.2 | 18,794.6 |

| Therapeutic Devices | 12,518.5 | 13,778.2 | 15,186.2 | 16,761.8 |

| Home Mobility Assist Devices | 19,053.7 | 20,602.0 | 22,238.5 | 23,965.3 |

The home mobility assists devices segment accounted for the largest share of the market in 2023. This is primarily due to the growing elderly population worldwide and the rising number of disabled people. Mobility assists devices include orthotic devices, power scooters, underarm crutches, wheeled walkers, artificial limbs, and wheelchairs. These devices assist people with mobility issues due to surgeries or accidents. They improve knee and hip functions while relieving pain and preventing further musculoskeletal injury in the elderly. Advancements in healthcare technologies have made these devices more user-friendly and smarter. These mobility aids also help manage the daily activities of people experiencing some kind of disability. Some benefits of these devices include independence, less pain and tiredness, better lifestyles, fewer chances of falling, and better movement.

- In September 2024, TGA Mobility introduced the Rollbuddy, a lightweight indoor rollator walker designed for easy maneuverability and security. Available in matt black, silver, or copper finishes, it features a braking system and a removable tray for easy cleaning.

Service Insights

Home Healthcare Market, By Service, 2020-2023 (USD Billion)

| By Services | 2020 | 2021 | 2022 | 2023 |

| Rehabilitation | 109,827.8 | 118,814.4 | 128,382.9 | 138,558.7 |

| Telehealth | 16,600.1 | 25,123.7 | 35,992.5 | 50,859.5 |

| Respiratory Therapy | 33,077.7 | 37,868.8 | 41,270.1 | 45,447.4 |

| Infusion Therapy | 14,687.9 | 17,200.3 | 19,171.6 | 21,589.3 |

| Unskilled Homecare | 46,466.1 | 51,485.0 | 54,213.8 | 57,579.5 |

The rehabilitation segment led the home healthcare market in 2023. Rehabilitation is critically important to achieve universal health coverage, which involves disease prevention, treatment, and palliative care. It aids people in preserving autonomy in activities of daily living as well as partaking in schooling, employment, recreation, and family responsibilities. There is a high demand for rehabilitation services due to the growing aging population and instances of chronic diseases and disabilities. Home healthcare providers offer various rehabilitation services, such as physical, occupational, speech, and cognitive rehabilitation therapies.

- According to a report published by the WHO, approximately 2.4 billion people worldwide are suffering from different health conditions that require rehabilitation.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2024 to 2034 | CAGR of 13.05% |

| Market Size in 2023 | USD 373.56 Billion |

| Market Size in 2024 | USD 423.97 Billion |

| Market Size by 2034 | USD 1,445.71 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Device, and By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Low cost associated with home healthcare to drive the growth of the home healthcare market

Home healthcare services are relatively cheaper when compared to hospitalization or institutional care as they minimize the use of emergency rooms and hospital admissions. Home care is very flexible and can be tailored according to a patient’s needs, resulting in enhanced health outcomes and patient satisfaction. Many studies demonstrate that home healthcare is efficient and saves millions of dollars each year. Home care managed by skilled health practitioners enhances the patient’s health status and prevents them from visiting the emergency department, in-patient facilities, and/or outpatient clinics. In addition, home healthcare is more cost-effective within the Medicare system than other forms of institutional care.

Restraint

Lack of skilled professionals hindering the market growth

Home healthcare facilities encounter staffing challenges. The shortage of skilled nurses in underdeveloped countries makes it difficult for people suffering from multiple health conditions to access and leverage nursing services. This may lead to severe health conditions and lifetime disability. Thus, it is advisable to build a large database of potential candidates and incorporate it into the recruitment process to alleviate difficulties with recruitment planning.

Read Also: Artificial Intelligence (AI) Market Size to Cross USD 3,680.47 Bn by 2034

Opportunity

Technological advancements offer opportunities in the home healthcare market

Advanced technologies, such as sophisticated electronic health records, have transformed home health care by streamlining patient information and enhancing diagnosis accuracy and treatment efficacy. In addition to this, they have improved data security and patient privacy by putting in place measures such as encryption and access control. There is significant growth in incorporating artificial intelligence and machine learning in the home healthcare system, enabling proactive healthcare practices and detecting patterns and crises. Likewise, machine learning is also highly used to personalize care plans and improve the quality of treatments.

Home Healthcare Market Companies

Manufacturers:

- McKesson Medical-Surgical Inc.

- Fresenius Medical Care

- Becton, Dickinson And Company

- Arkray, Inc.

- Medline Industries, Inc.

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Braun Melsungen AG

- ConvaTec Group PLC

- Molnlycke Health Care

- Acelity L.P.

- Hollister Inc.

- Others

Service Providers

- Sunrise Carlisle, LP

- Extendicare, Inc.

- Brookdale Senior Living, Inc.

- Home Health Services Ltd.

- Care UK Limited

- Kindred Healthcare, Inc.

- Genesis Healthcare Corp.

- Sompo Holdings, Inc.

- Home Instead Senior Care, Inc.

- Others

Recent Developments

- In July 2024, Star Health and Allied Insurance Company launched home healthcare services in 50 cities, with plans to expand to other cities.

- In June 2024, Addus HomeCare Corporation acquired Gentiva’s personal care operations for US$ 350 million, with regulatory approvals expected and funding through an existing revolving credit facility.

- In April 2024, the FDA launched the Home as a Health Care Hub initiative, aiming to promote home healthcare models and solutions that enhance health quality.

- In December 2023, H.I.G. Growth Partners sold Just Home Healthcare Services, a portfolio company, to Honor Health Network and RHA Health Services in April and October 2023, respectively.