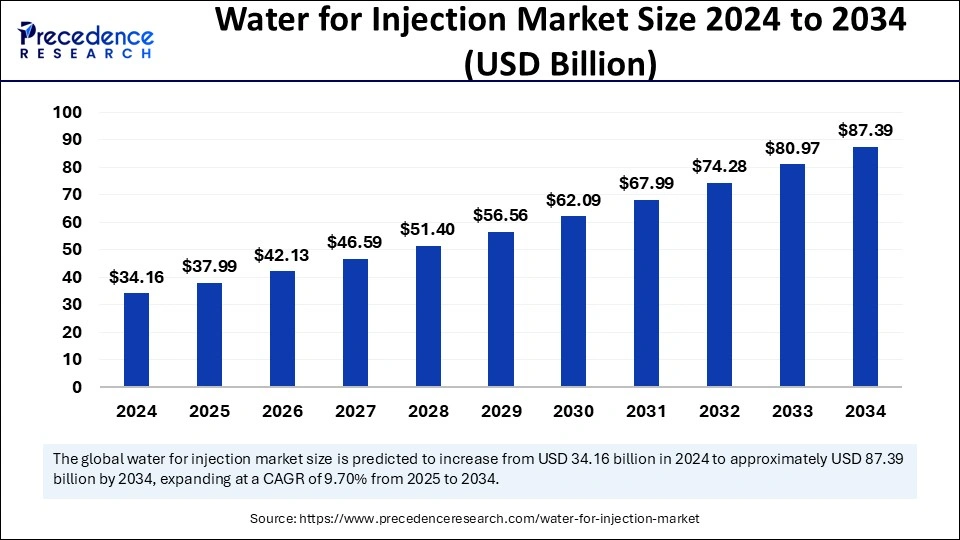

The global water for injection market size is accounted to hit around USD 87.39 billion by 2034, increasing from USD 34.16 billion in 2024, with a CAGR of 9.70%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5803

Water for Injection Market Key Insights

-

North America was the leading region in 2024, with a market share of 39.72%.

-

The Asia Pacific market is poised for rapid growth, expected to rise at a CAGR of 10.07%.

-

Formulated parenteral drugs represented the largest application share in 2024, totaling 65.02%.

-

The solvent application segment is expected to witness the fastest growth rate of 9.76%.

-

The pharmaceutical and biotech industry dominated the end-user segment in 2024 with 43.05%.

-

Research institutes are projected to experience the highest growth rate among end users at 9.73%.

Role of Artificial Intelligence (AI) in the Water for Injection (WFI) Market

Artificial Intelligence is playing an increasingly vital role in optimizing Water for Injection production, distribution, and quality control processes. AI-powered predictive maintenance tools help monitor equipment used in WFI systems—such as distillation units and filtration setups—allowing for early detection of faults, reducing downtime, and enhancing operational efficiency. Machine learning algorithms can also predict water demand more accurately, helping manufacturers scale production efficiently and reduce energy consumption.

In addition, AI improves quality assurance and compliance by enabling real-time monitoring of critical parameters like conductivity, temperature, and microbial contamination levels. Automated data analytics streamline regulatory reporting and help meet stringent GMP (Good Manufacturing Practices) standards. As AI integration expands, it enhances precision, reduces human error, and supports the development of smarter, more resilient WFI production systems.

Water for Injection (WFI) Market Growth Factors

-

Rising Demand in Pharmaceutical and Biotechnology Industries:

The increasing production of pharmaceuticals and biopharmaceuticals necessitates high-purity water for formulation, dilution, and cleaning processes, thereby boosting the demand for WFI. -

Stringent Regulatory Standards:

Regulatory bodies worldwide are enforcing strict guidelines for water purity in drug manufacturing. Compliance with these standards compels pharmaceutical companies to invest in reliable WFI systems, propelling market growth. -

Advancements in Water Purification Technologies:

Innovations in purification methods, such as membrane-based reverse osmosis and ultrafiltration, have enhanced the efficiency and cost-effectiveness of WFI production, encouraging adoption across the industry. -

Expansion of Healthcare Infrastructure:

Developing regions are witnessing substantial investments in healthcare facilities, leading to increased pharmaceutical manufacturing activities and, consequently, a higher demand for WFI. -

Growth in Injectable Drug Formulations:

The shift towards injectable therapies, driven by their rapid efficacy and the rise of biologics, has amplified the need for WFI, which is essential for these formulations.

Water for Injection Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 87.39 Billion |

| Market Size in 2025 | USD 37.99 Billion |

| Market Size in 2024 | USD 34.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.70% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Water for Injection Market Dynamics

Drivers

Primary drivers include the growth in pharmaceutical manufacturing, rising injectable drug consumption, and strict global regulations requiring ultra-pure water in sterile processes.

Opportunities

Untapped markets in Asia, Latin America, and Africa present valuable expansion opportunities. Adoption of smart water systems and environmentally sustainable WFI generation methods also offers future growth potential.

Challenges

Cost-intensive infrastructure, energy demands, and rigorous regulatory compliance pose challenges to market entry and scalability, particularly for smaller manufacturers.

Regional Insights

North America holds the largest market share due to a strong pharmaceutical presence. However, Asia Pacific is expected to register the fastest growth rate, driven by increased investments and pharmaceutical manufacturing capacity.

Water for Injection Market Companies

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Eurocrit Labs International

- Evoqua Water Technologies

- Veolia Water Solutions and Technologies

- ICU Medical Inc.

- Danaher Corporation (Cytiva)

- Rocky Mountain Biologicals

- B. Braun Melsungen AG

- SteriCare Solutions

- Veltek Associates, Inc.

Latest Announcements by Industry Leaders

- In December 2024, CN Water and its partner BWT Pharma and BioTech launched Cold/Ambient Water for Injection technology to the Indian pharmaceutical industry through its OSMOTRON WFI product. This technology reduces energy consumption significantly in the pharmaceutical manufacturing ecosystem.

Recent Developments

- In January 2025, UK Dredging unveiled the water injection dredger UKD Seadragon at Damen Shipyards. The state-of-the-art vessel is based on a Shoalbuster 2711 design and introduces an innovative approach to water injection dredging, offering exceptional efficiency and flexibility.

- In November 2024, Veolia Water Technologies introduced mobile water services for the pharmaceutical, cosmetics, and life sciences industries across Europe. This service offers reliable, uninterrupted, and sustainable solutions for manufacturing, cleaning, and complex liquid waste treatment for compliant offsite management.

Segment Covered in the Report

By Application

- Formulate Parental Drugs

- Solvent

- Cell Culture Media

- Laboratory Reagents

- Synthesis of Drugs

- Others

- Cleaning Agents

- Rinsing Vessels

- Cleaning Equipment

- Cleaned primary Packaging Materials

By End-user

- Pharmaceutical and Biotechnology Companies

- Research Institutes

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: ELISpot and FluoroSpot Assay Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/